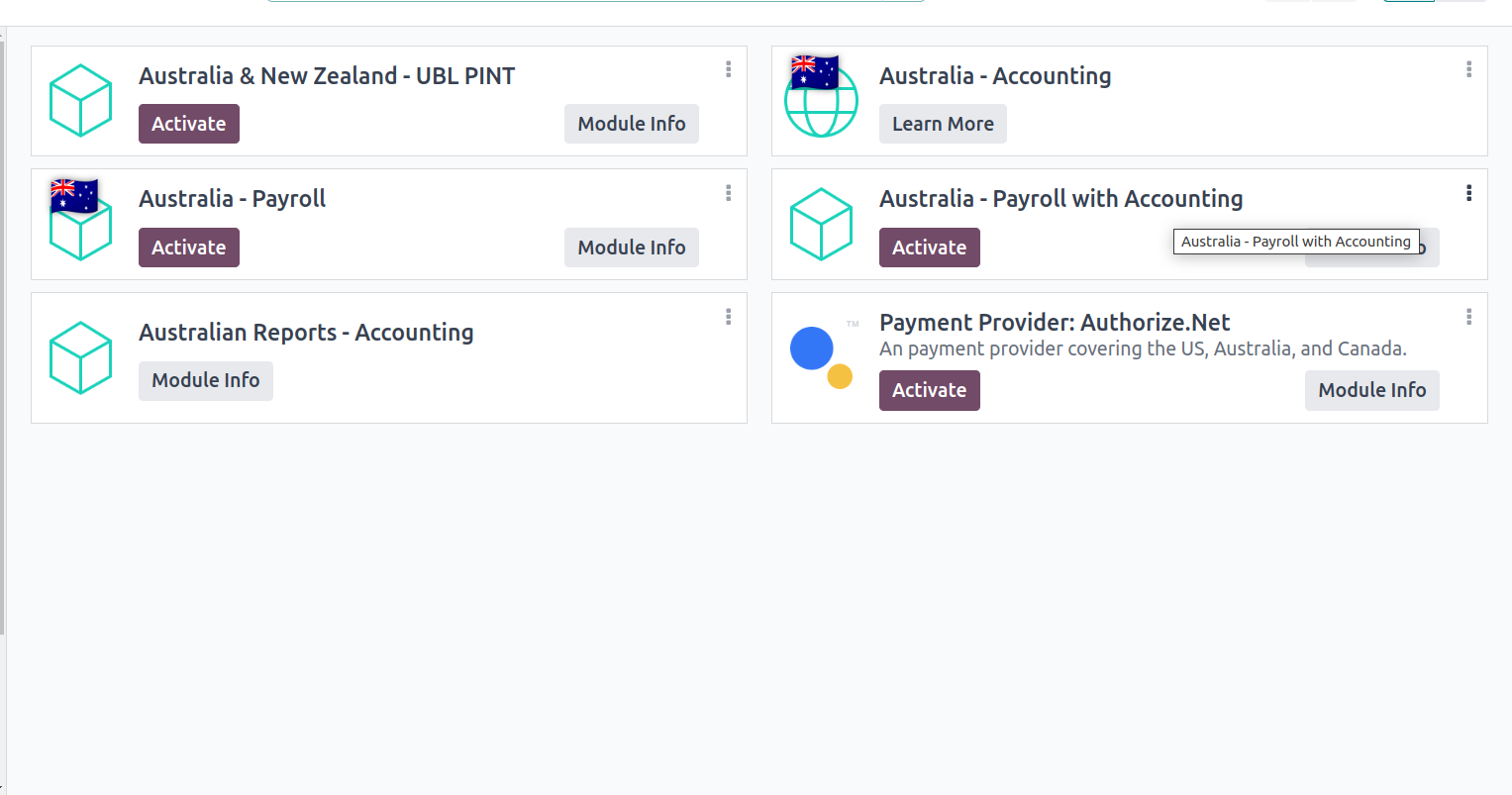

Odoo excels in adapting to Australia's unique regulatory landscape. Its comprehensive Australian Localization Package is designed to handle local tax laws, including GST configuration, ATO reporting, and employment regulations. This package ensures compliance with industry-specific standards, simplifying business regulatory navigation. Here, we will display the Australian Localization benefits of Odoo.

Compliance Requirements Management

FBT Returns: Employers must lodge an FBT return annually by 21 May unless an extension applies.

Record-Keeping: Employers must maintain accurate records of benefits, business use vs. private use, and employee declarations.

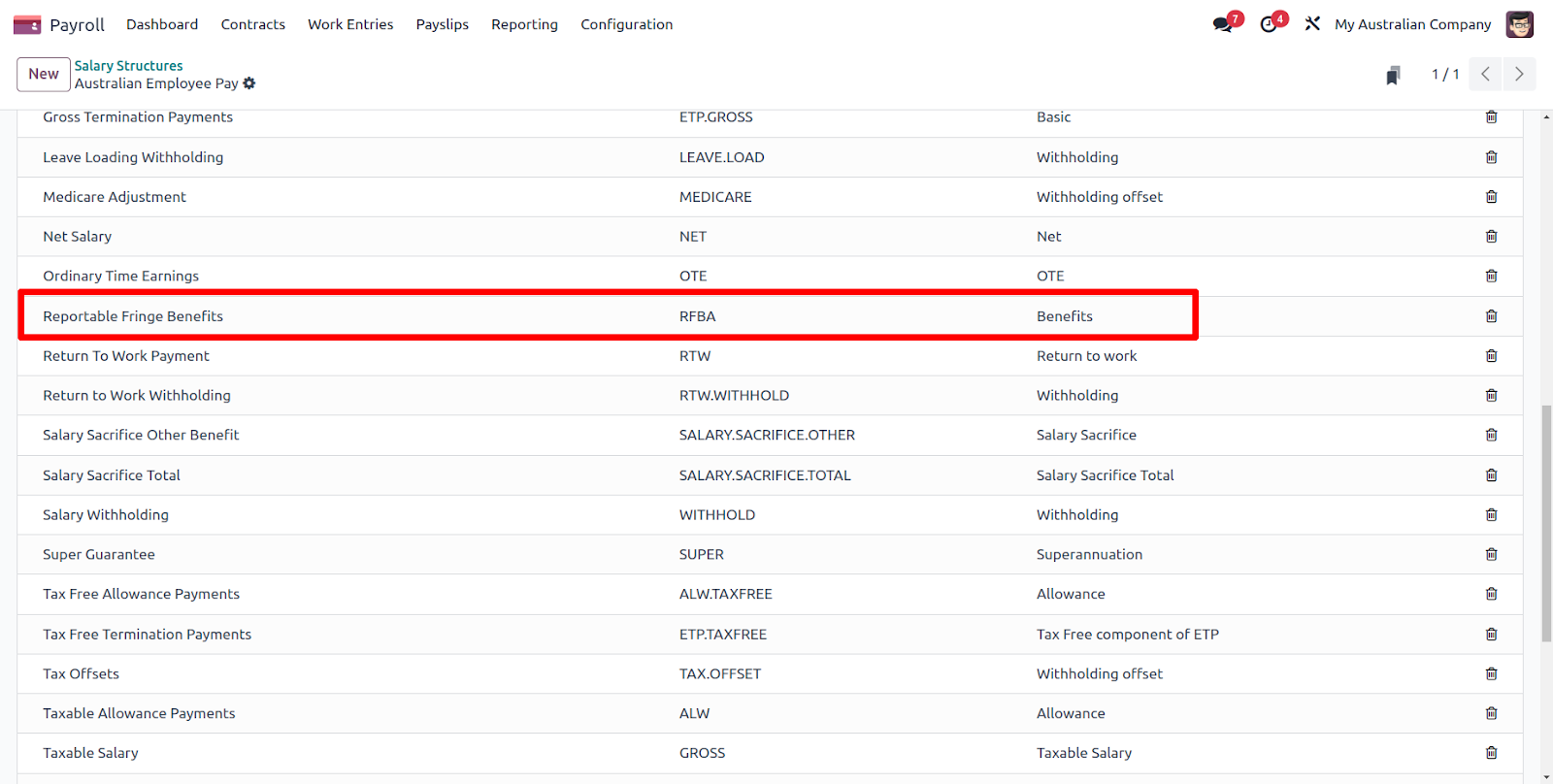

Reportable Amount: If the reportable fringe benefit exceeds AUD 2,000, it must be included on the employee's income statement.

Tax Calculation Tools: Use Odoo’s integration with third-party tax calculation tools (if available) for accurate PAYG and superannuation calculations.

Leave Balances: Include accrued leave balances for full compliance with Australian laws.

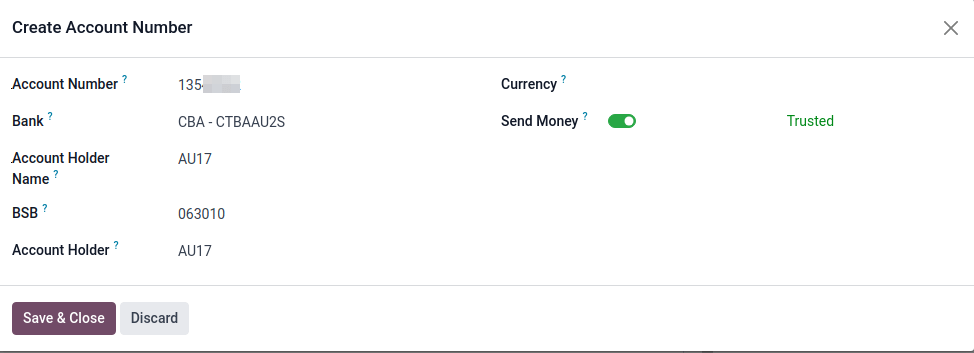

ABA Files for Batch Payments

The integration of ABA files for batch payments streamlines payment processing by consolidating multiple payments into a single file format compatible with Australian banks, improving efficiency and accuracy in financial transactions.

ABN Lookup

Automating ABN (Australian Business Number) lookup and company information updates in Odoo enhances data accuracy and streamlines business processes. This integration ensures up-to-date company details, improving efficiency and compliance.

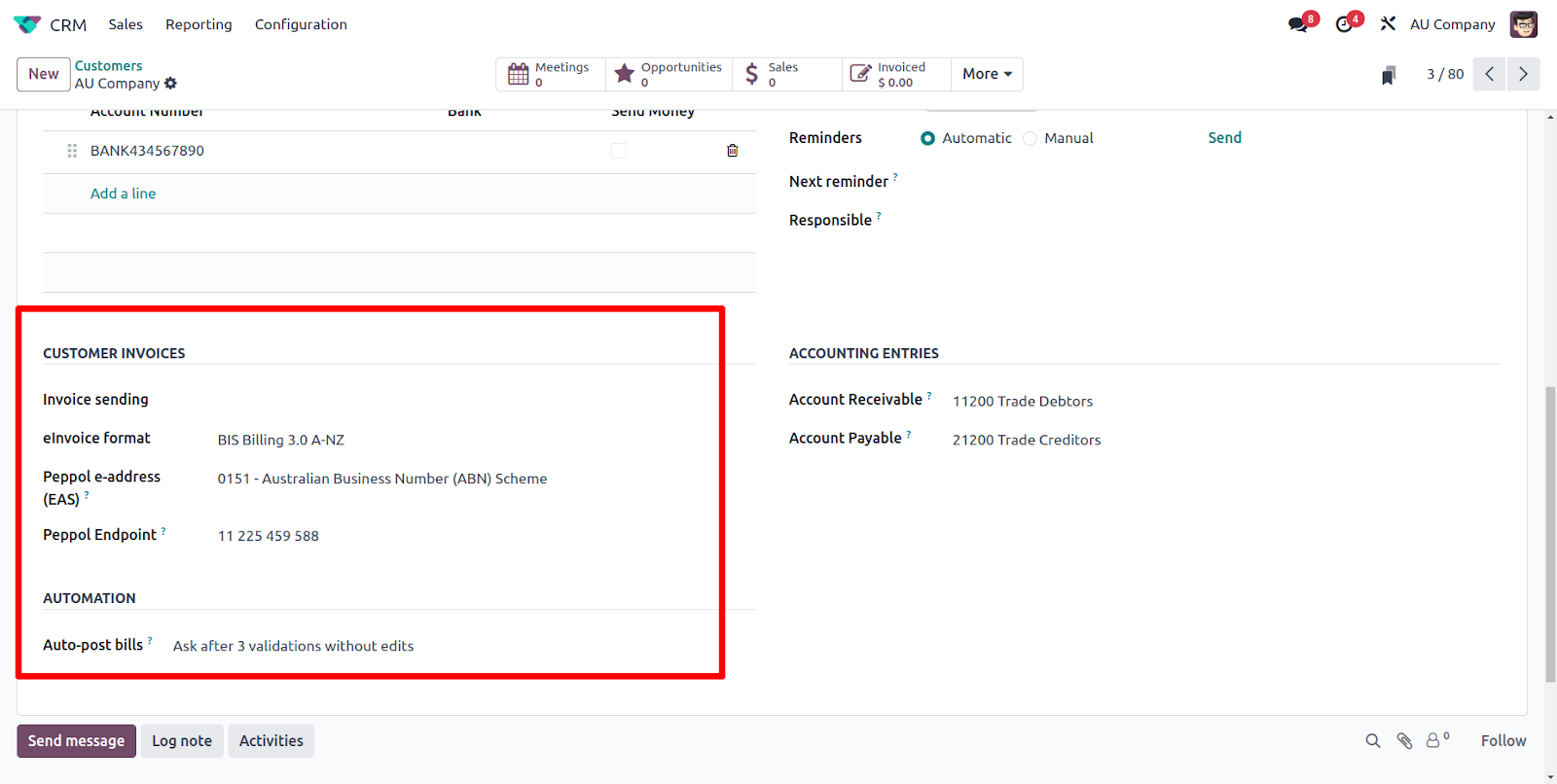

Peppol

Odoo now integrates with PEPPOL (Pan-European Public Procurement Online) A-NZ BIS Billing 3.0, enhancing secure electronic document exchanges, such as e-invoices and purchase orders, between businesses and governments in Australia and New Zealand. This seamless integration allows users to streamline business processes, and easily format, generate, and export documents like customer invoices and credit notes directly from the Odoo platform.

Link to Time Off and Accounting

The Payroll module is effortlessly linked to accounting through journal entries connected to the Business Activity Statement (BAS) report. It also integrates with time-off applications.

This means that when employees take paid time off, the odoo system automatically handles the necessary calculations and entries, making the process hassle-free for users.

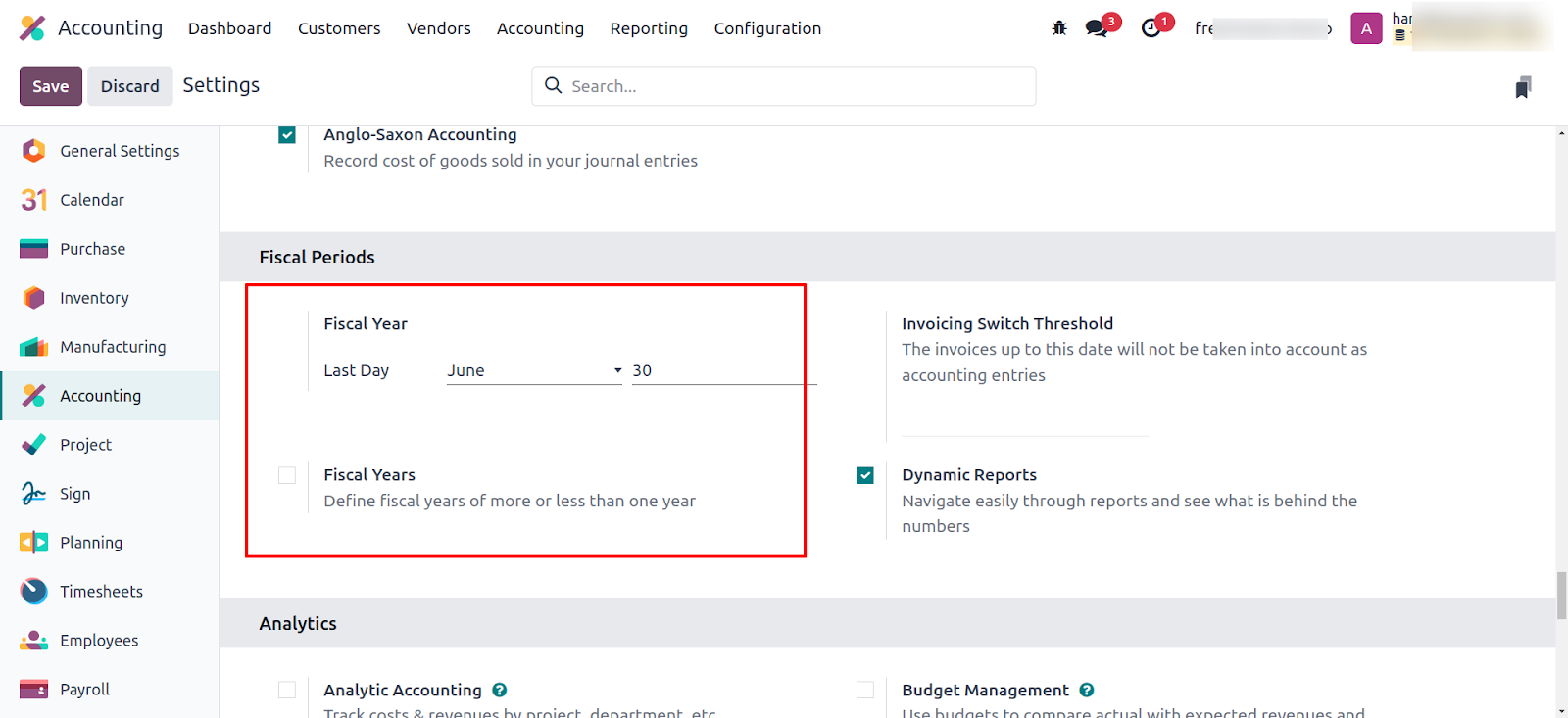

Fiscal Years

Odoo's localization module streamlines fiscal period management for Australian businesses by automatically setting June 30 as the fiscal year's end date.

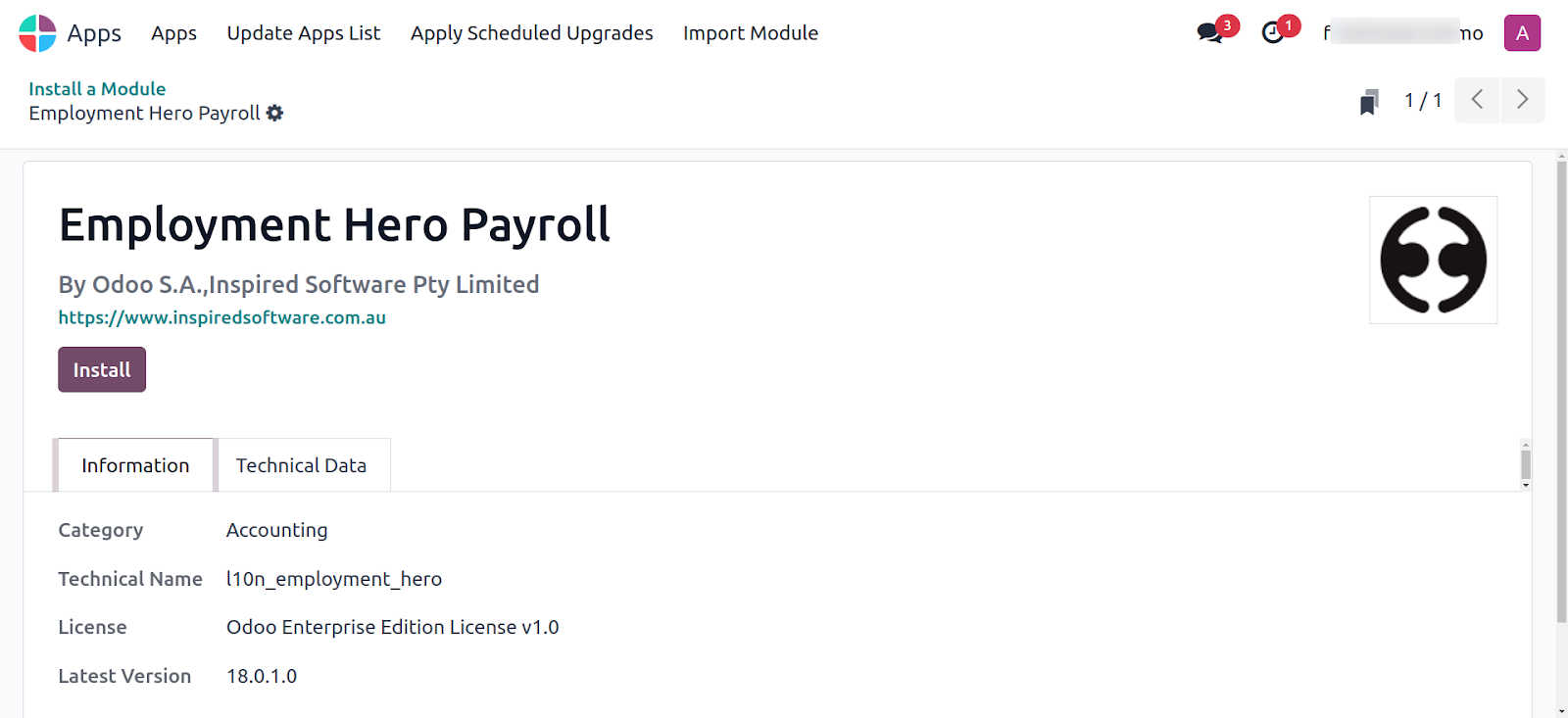

Employment Hero Australian Payroll

The Employment Hero module with Australian odoo payroll synchronizes payslip accounting entries (e.g., expenses, social charges, liabilities & taxes) from Employment Hero to odoo automatically. Payroll administration is still done in the Employment Hero module.

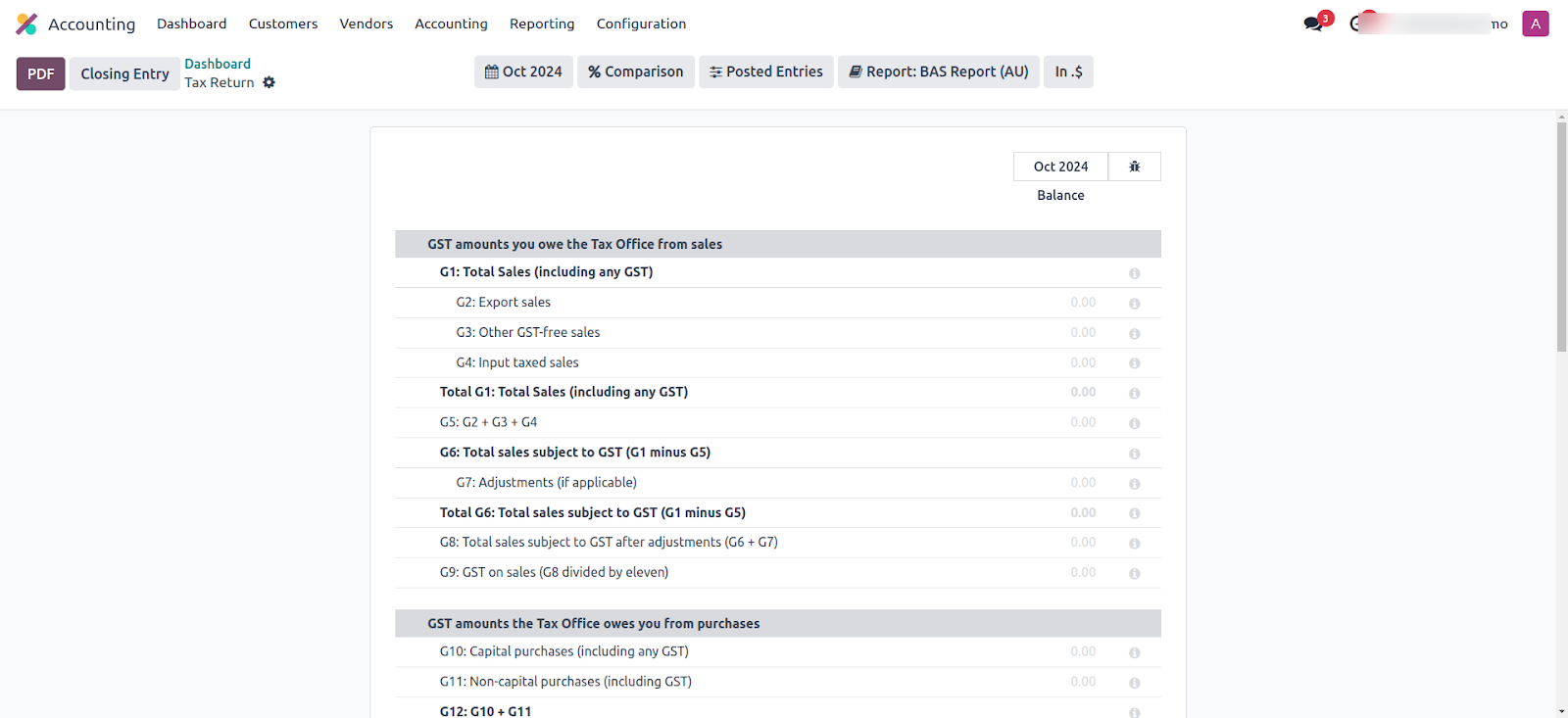

BAS Report Improvements

The BAS report is crucial for Australian businesses registered for Goods and Services Tax (GST). It serves to report and remit various taxes to the Australian Taxation Office (ATO).

Recently with Odoo 18, there have been notable improvements to the BAS report. Odoo now includes sections for PAYG tax withheld, enhancing the accuracy of capturing and reflecting all payroll-related withholding taxes within the report. This integration ensures that your tax reporting is more comprehensive and precise.

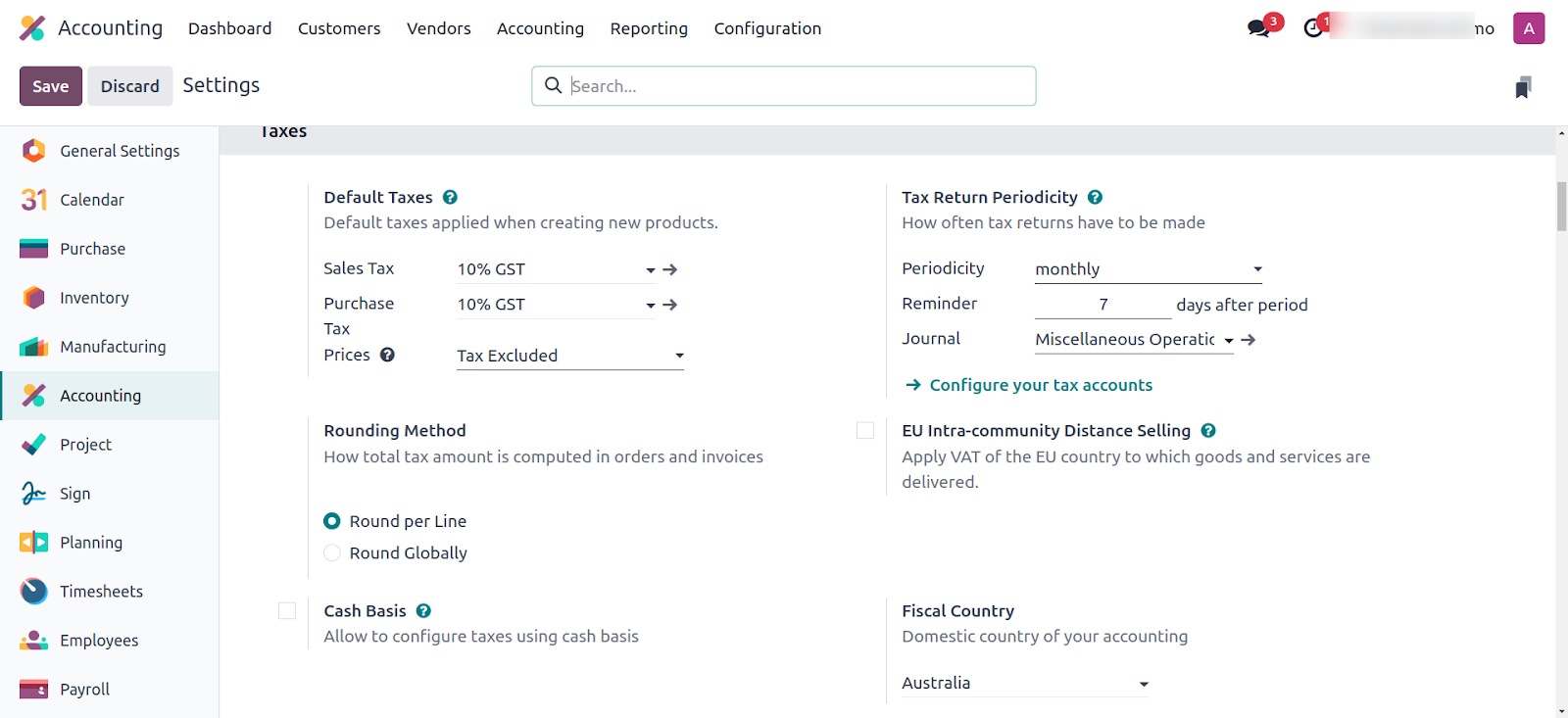

Australian Terms

In Odoo, the Australian English (AU) language is automatically installed in databases. This ensures the use of localized terms like GST and BAS reports configured by default, making the platform more user-friendly and aligned with Australian business practices.

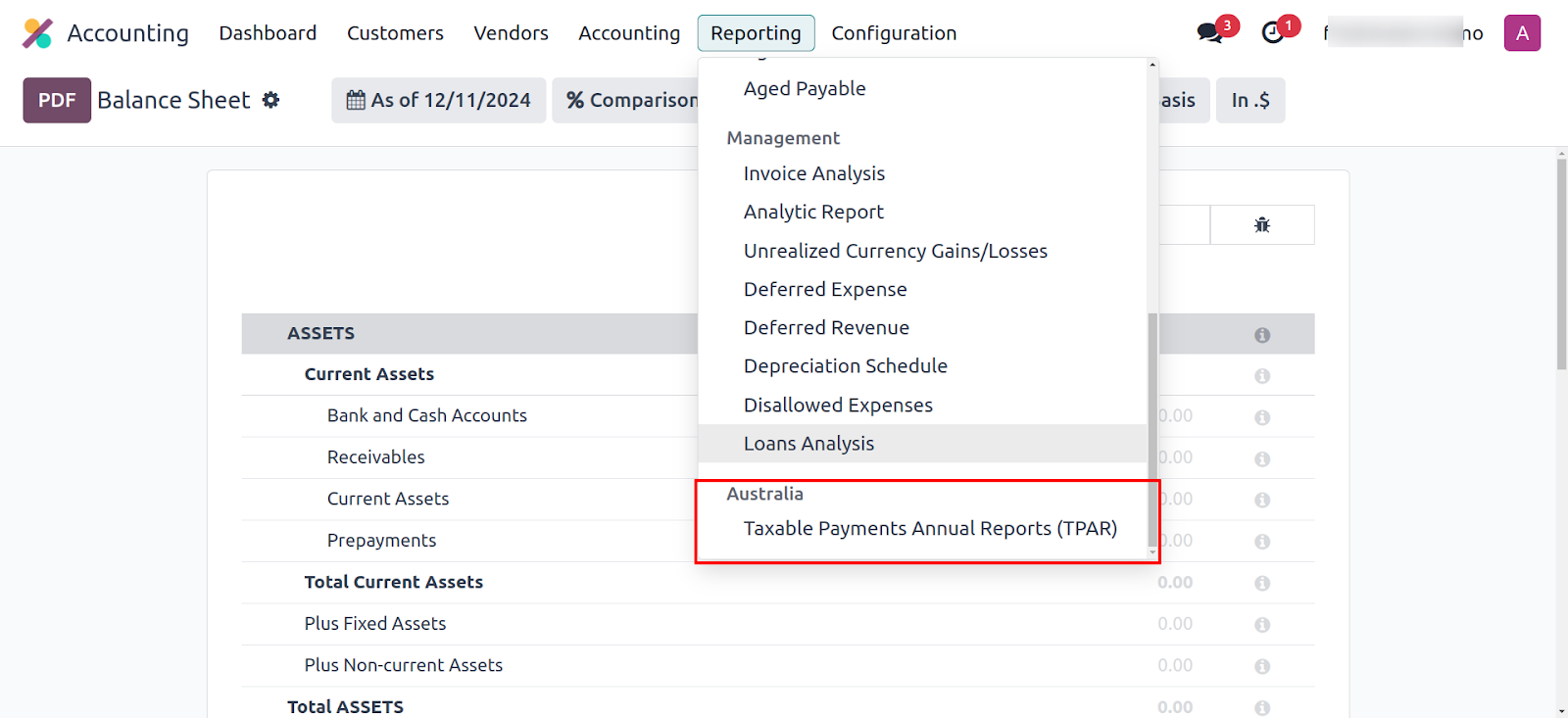

TPAR Report

Odoo Australia enables the TPAR reports with a reporting section TPAR Reports helps to track taxable payments and the annual reports that must be filled to the Australian Taxation Office (ATO) & it shows how much money was paid to workers for services they provided during the reported time period.

Fringe Benefits tax (FBT)

Australian laws employers are required to pay the Fringe benefits Tax (FBT) on certain benefits that are given to employees/workers (or their family members) in lieu of pay or salary. FBT is computed on the taxable value of the benefits rendered and is separate from income tax.

Conclusion

For Australian businesses seeking a scalable & cost-effective solution, Odoo is a smart choice. Its adaptability to various business needs with the Australian business landscape makes it a strategic choice for streamlining operations & fostering business growth.

Odoo's Australian localization empowers businesses to manage their operations in compliance with Australian laws and regulations, ensuring tax accuracy, streamlined payroll, and simplified reporting. Whether it's automating GST calculations, integrating with local banks, or simplifying payroll management with STP, Odoo's robust features cater to the needs of Australian businesses.

SerpentCS, a proud Odoo partner expertise in Odoo implementation, Integration, customization & migration services. If you’re looking to enhance your existing business management system, reach out to us via contact@sepentcs.com. Our reliable solutions are designed to optimize your business processes.