Explore Indian Accounting Feature in Odoo 18

A business’s accounting process deals with customer invoices & vendor bills, which is fundamental to the business. Reconciliation of this business unit's accounts is facilitated by Odoo 18 Accounting, which seamlessly integrates with the other modules. Odoo 18 allows businesses to avoid worrying about complex accounting components and focus on growth and development. This blog will further explain how TDS and TCS Tax Deduction alerts work.

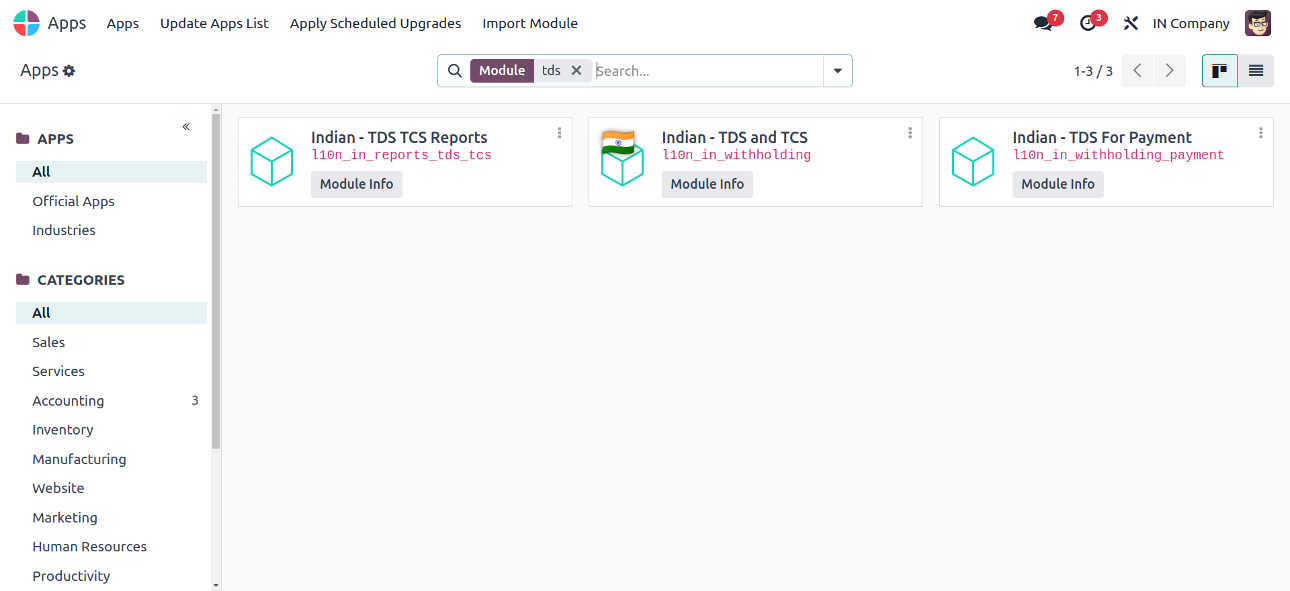

Firstly you need to activate the Indian TDS Support module from apps.

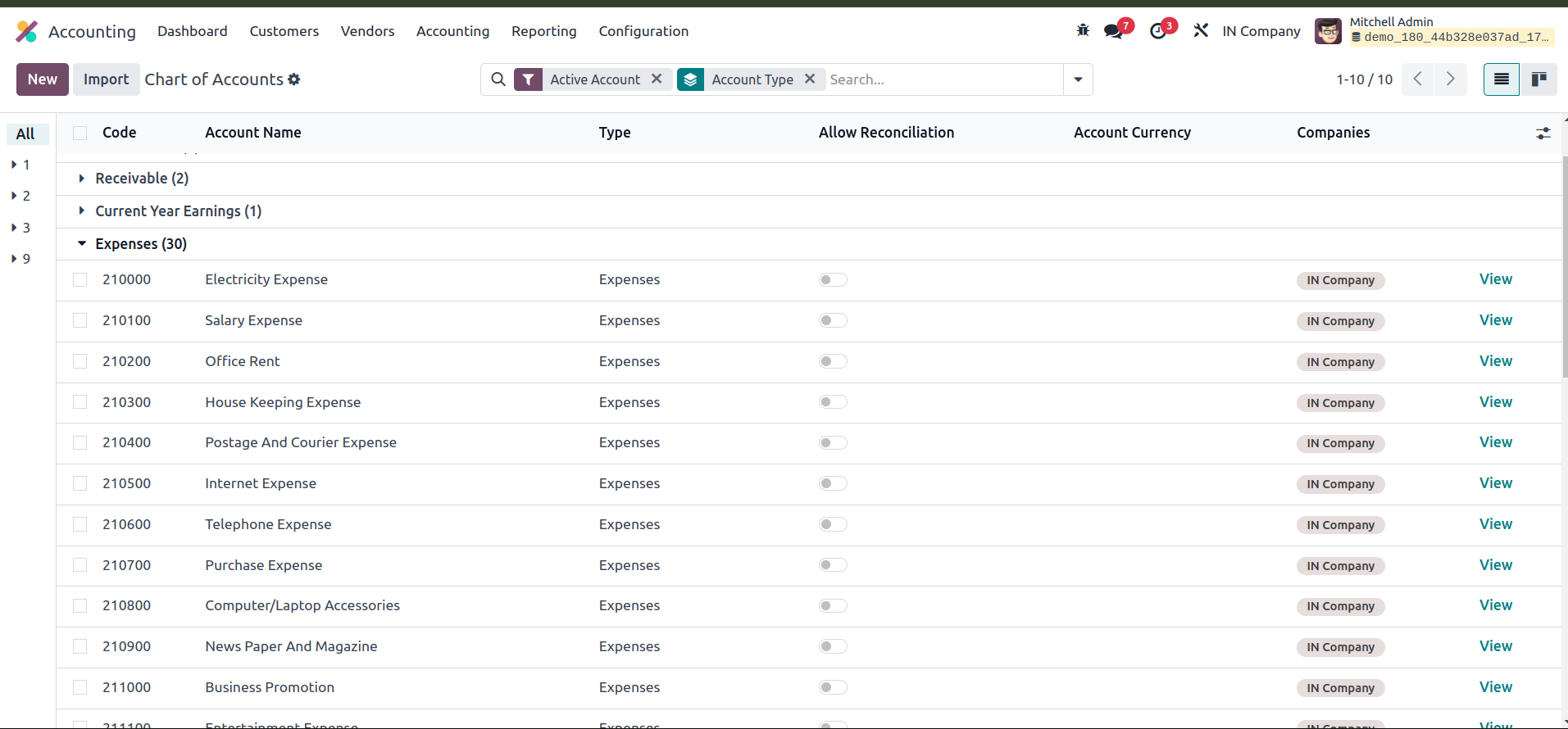

To begin, let’s look at the configuration process within Odoo 18 Accounting. First, navigate to the Chart of Accounts, where you can set up various ledger accounts, such as Internet Expenses, stationary expenses & electricity expenses, etc. In this configuration section, you can easily set up TDS & TCS.

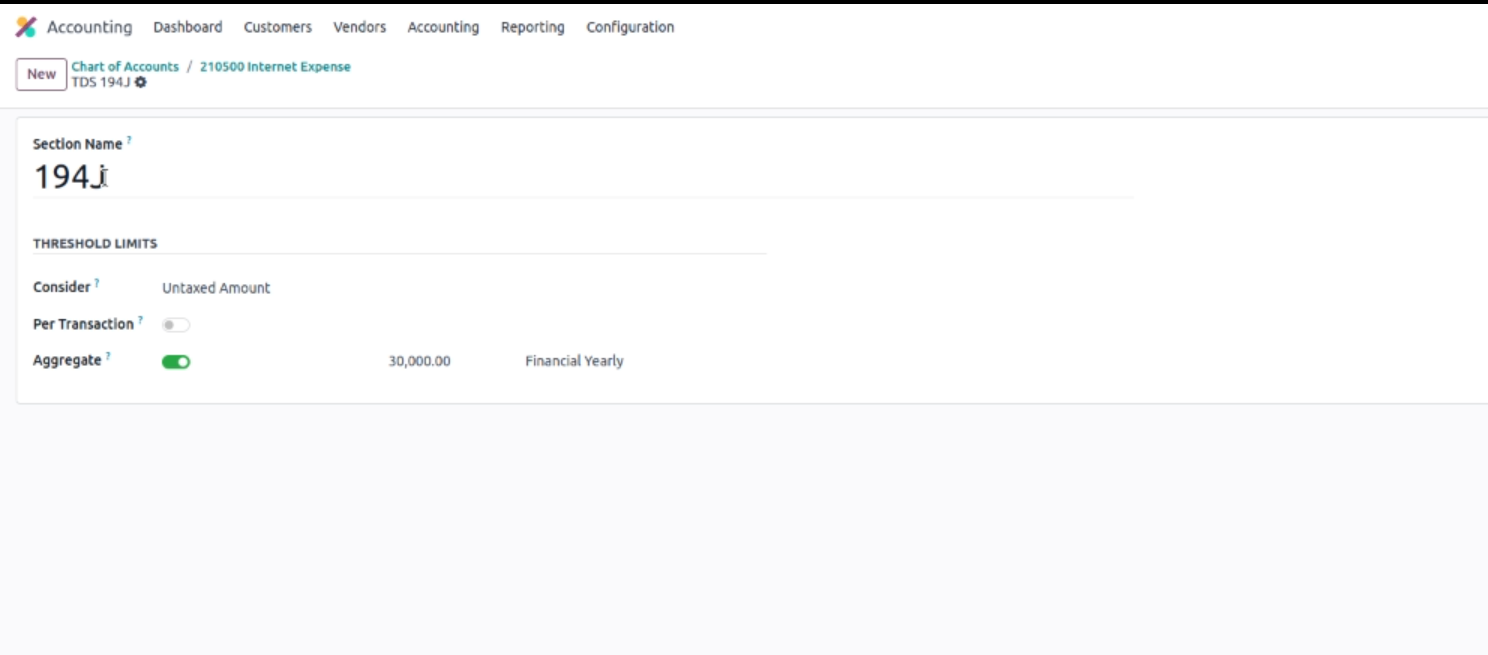

For example, within the Internet Expense account, I have already configured the relevant TDS —Section 194J. Upon review, you’ll notice that this section has been properly set up to handle TDS deductions as per Indian tax regulations.

Additionally, Odoo 18's Indian accounting module comes pre-configured with several sections, including TDS Sections 192, 194A, and others, all of which are automatically set up. For yearly financial calculations, the system automatically sets the threshold at ₹30,000, ensuring that the tax deductions are applied accordingly, based on the specific tax sections.

We must ensure the proper configuration of distinct ledgers and accurate account settings within the system. This includes verifying that the TDS sections are correctly set up and configured as per the applicable statutory requirements. Once this foundational setup is completed, we can proceed to define and configure additional expenses, such as electricity expenses.

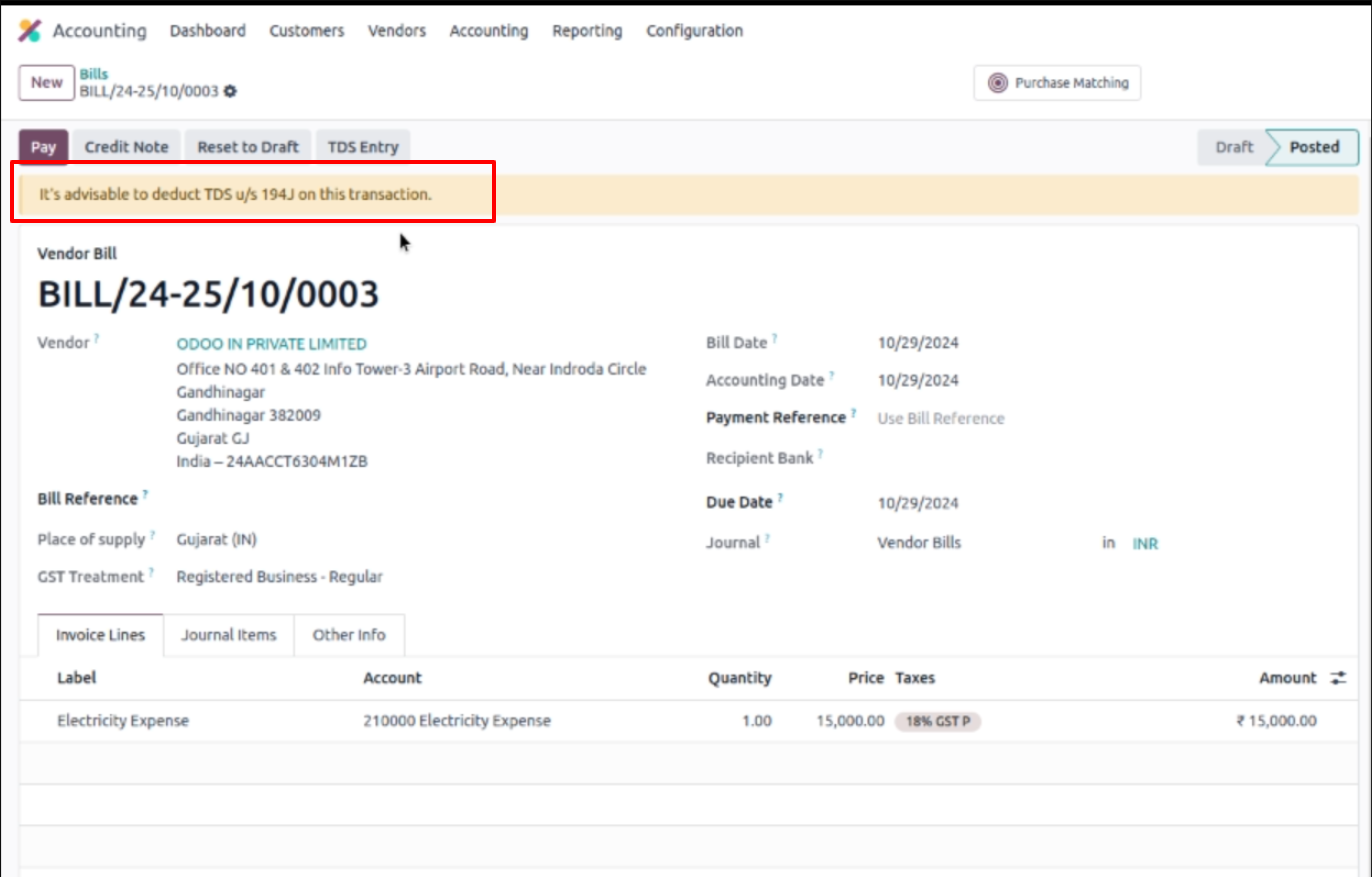

When recording the electricity expense, the system is designed to trigger an alert once the total aggregated amount exceeds ₹30,000, notifying me to deduct the applicable TDS (Tax Deducted at Source).

Let's take a closer look at the vendor bill—if I choose an electricity expense entry, for example, and the total purchase amount is ₹50,000, the system will prompt me to make the necessary TDS deduction.

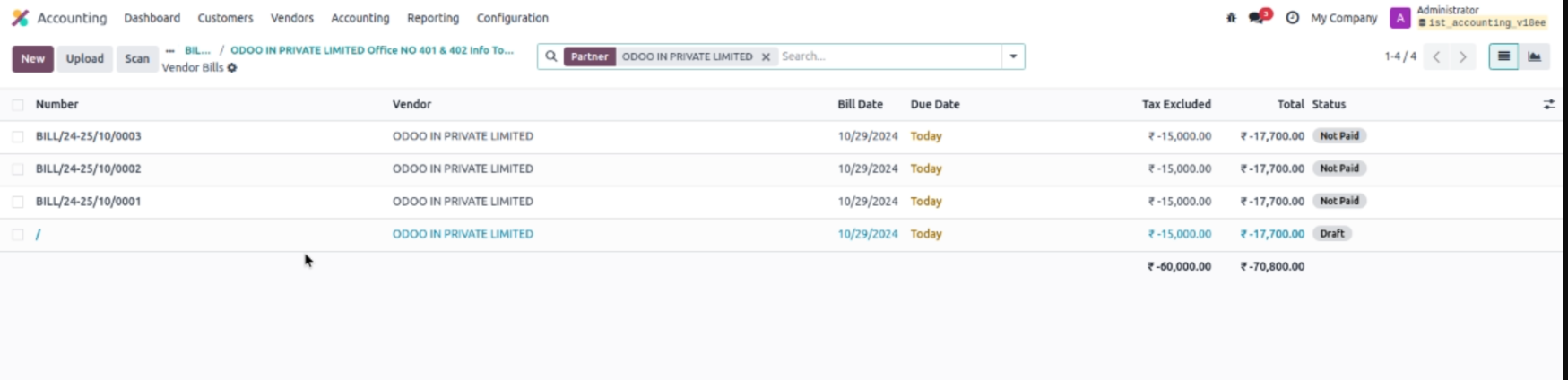

This alert is generated because the same vendor has multiple transactions under their vendor bills, ensuring compliance with tax regulations and accurate TDS calculations.

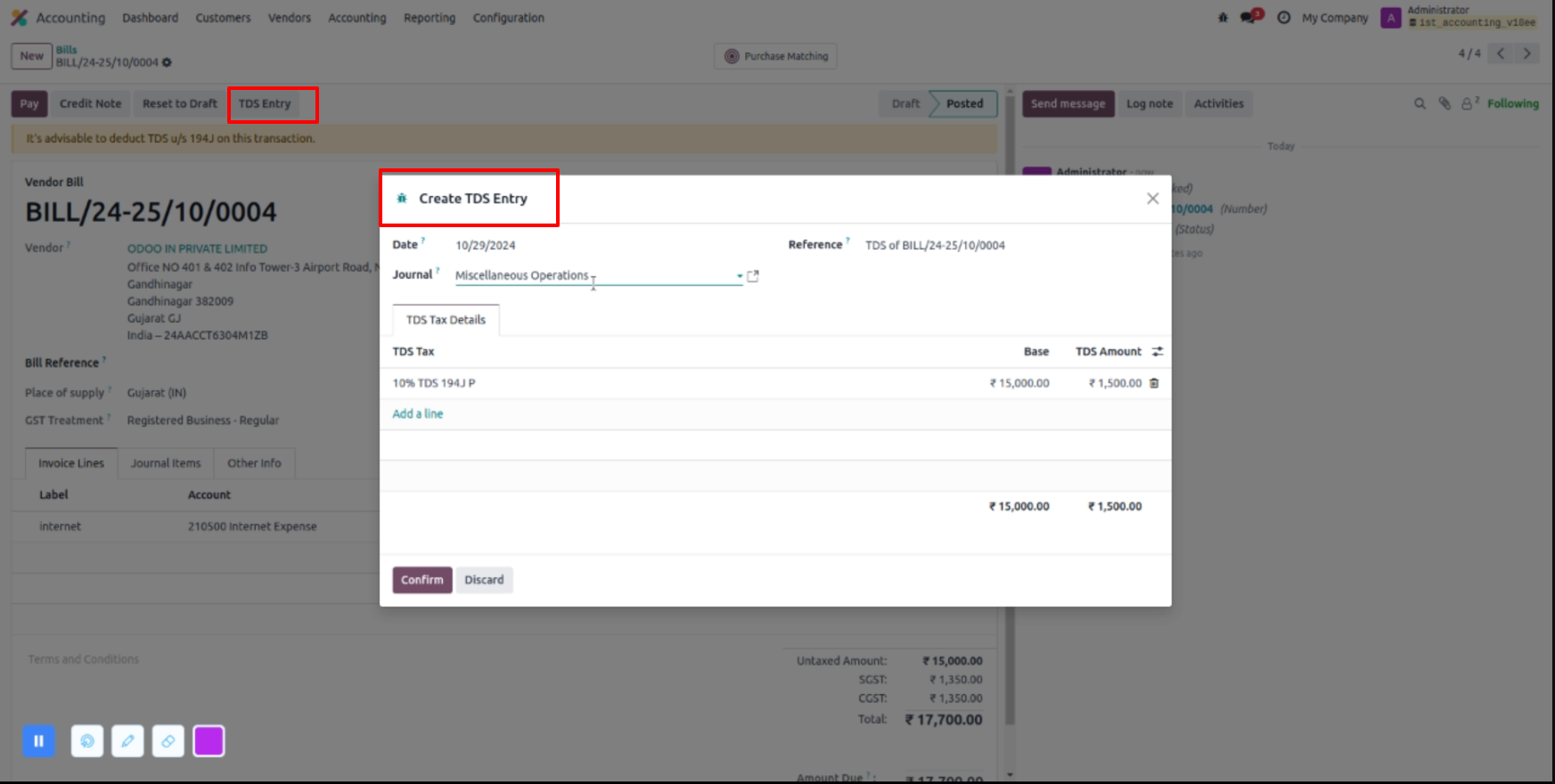

Once the system triggers the TDS alert for deductions, it’s recommended to apply TDS across all relevant transactions. After confirming, you can pass the TDS entry, selecting the appropriate section, such as 194J (for professional services), with the applicable rate (e.g., 10% on ₹15,000).

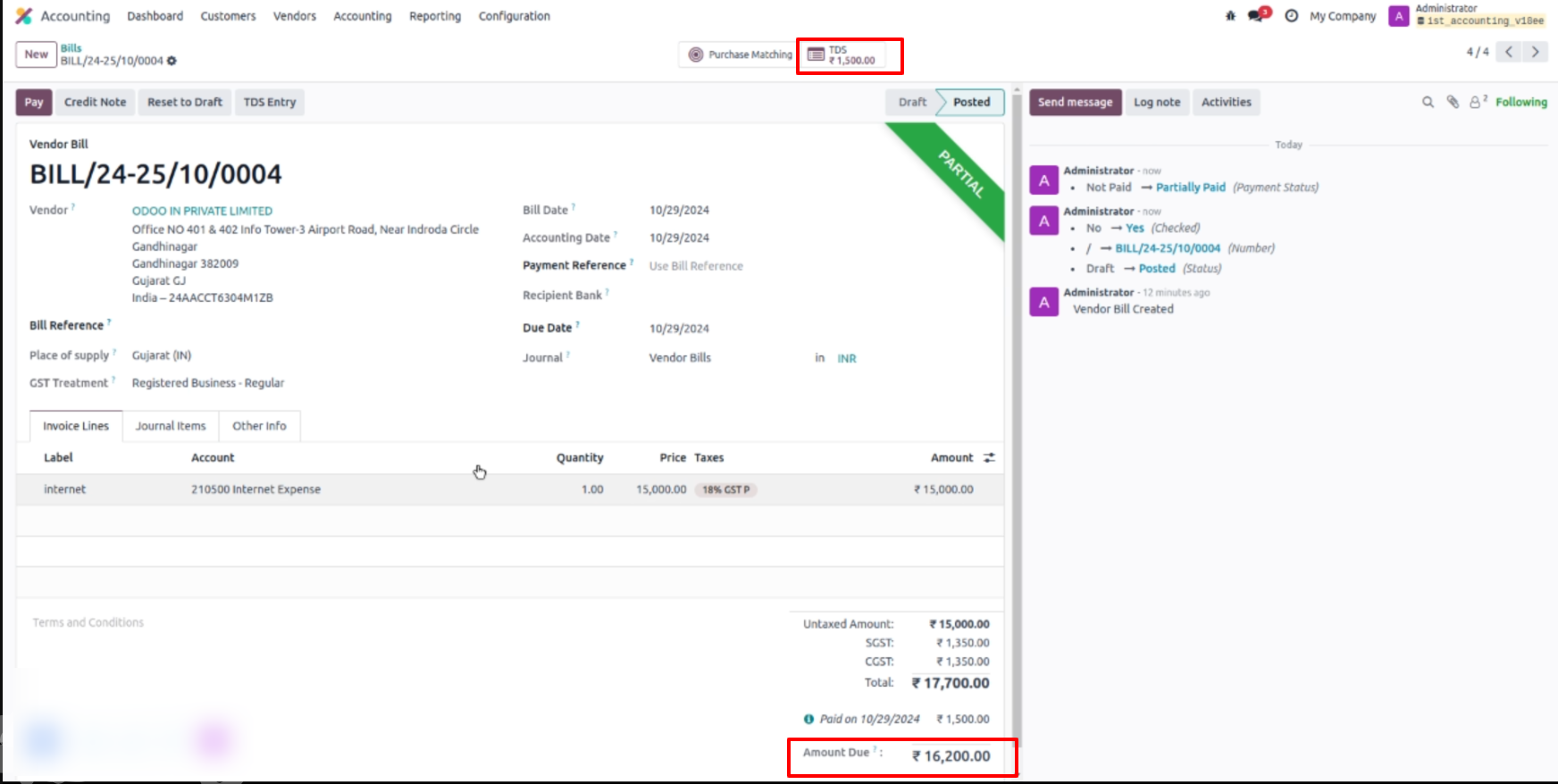

Additionally, creating a separate journal entry helps track TDS deductions, making it easier to cross-check pending TDS certificates from vendors when received.

Now, if you check, we have to just pay the remaining amount. The payable amount will be 16,200.

Similarly, it will work for the sales part as well. This is how we can utilize the new features of TDS and TCS alerts in odoo 18. Please check it out and let us know if you have any doubts.

Conclusion

So in this blog, we have discussed the Setup of accounting standards with TDS and TCS alerts with ledger postings that have been done while purchasing and selling items with Indian Accounting standards. Now we can say that Odoo 18 accounting offers a complete and efficient solution for companies, to know more about accounting Features contact us at contact@serpentcs.com so that you can explore Odoo Implementation Features.