Manage your finances more effectively, through Odoo 18 Accounting, and put an end to annoying slow software and crowded email boxes and making decisions with lots of data. The most persuasive of these advantages is its incredibly fast speed, which allows executing any operation in less than 90 milliseconds.This incredible speed means your accountants can do more in less time, boosting efficiency and productivity.

Main Features of Odoo 18 Accounting Software

Odoo succeeded in achieving their desires in meeting organizational strategy and resources. This Accounting module is designed to enhance efficiency by simplifying all financial transactions and accounting activities such as accounts receivable, accounts payable, bank transactions, fixed assets management, etc. It provides tools for double entry bookkeeping, multi currency, invoice categorization etc.

Here we are exploring Odoo 18 accounting new features launched at the Odoo Experience event 2024. Let's dive in

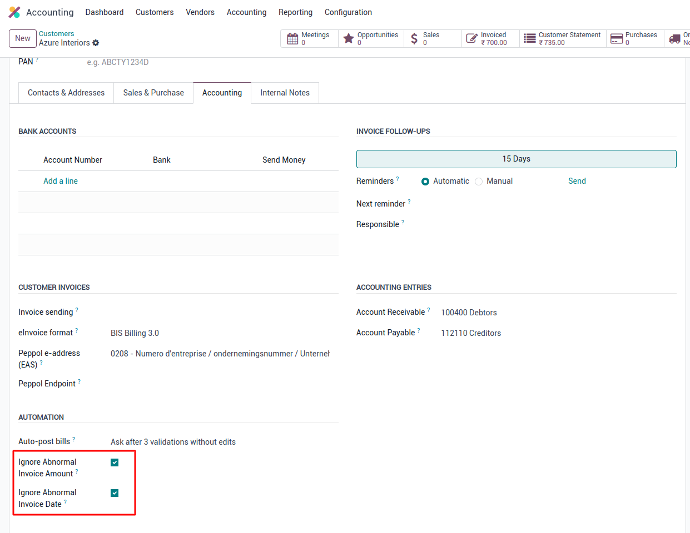

Abnormal Invoice alert

Odoo 18 has added a statistics-based alert system to automatically identify abnormal amounts and dates in invoices.

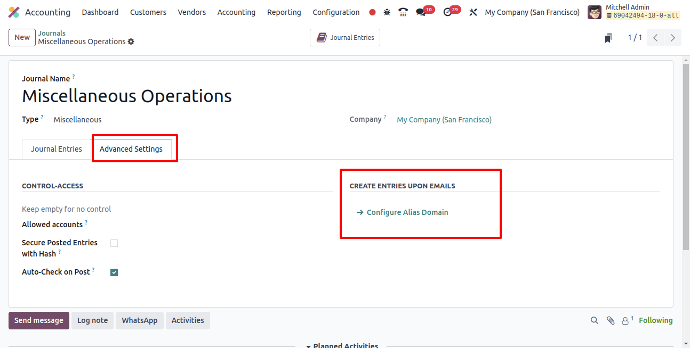

Allow email aliases on MISC journals

With Odoo 18 accounting users can add email aliases on miscellaneous journals to automatically create journal entries from email attachments.

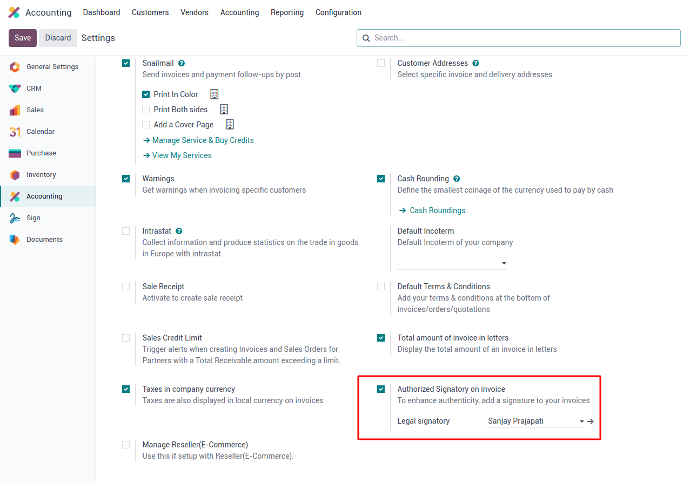

Authorized Signatory on invoice

Odoo 18 now enables features that allow you to add the sign of an authorized person in a customer invoice.

Analytic budgets

Odoo 18 introduces new budget management. No more dates on budget lines; no more budgetary positions.

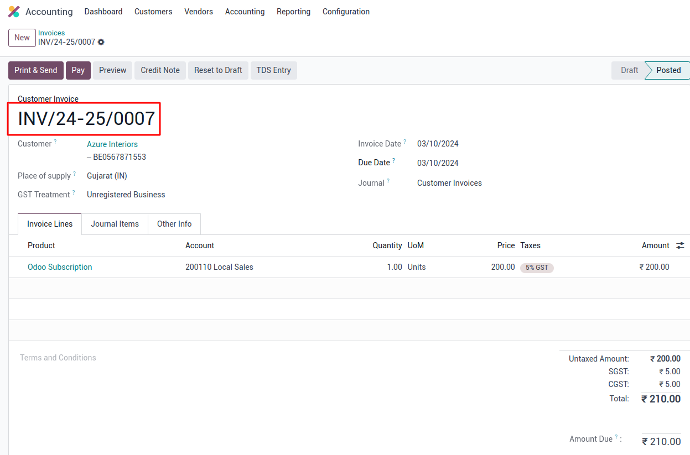

Annual sequence and staggered fiscal years

Odoo 18 improves the fiscal year sequence on journals that can differ from calendar years to handle staggered fiscal years.

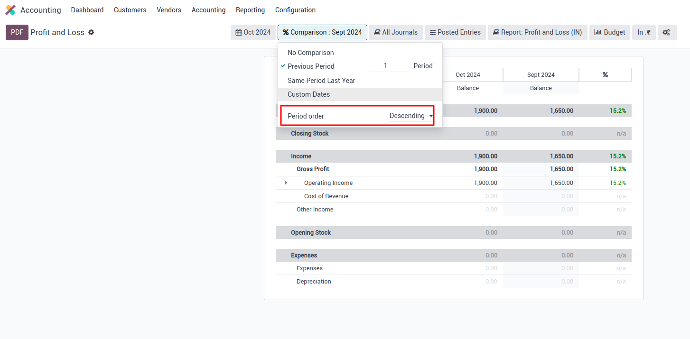

Ascending/descending report dates

Odoo 18 enables reporting to Switch the order of your date columns (ascending/descending) when using date comparisons.

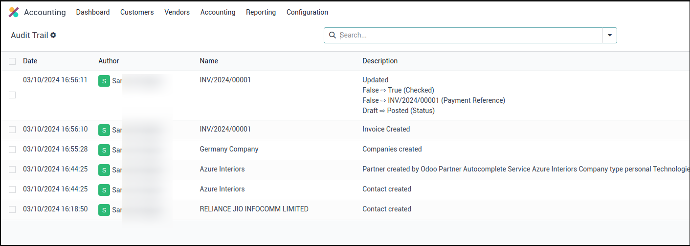

Audit trail improvements

In odoo 18 the audit trail has been improved, namely in the context of the GoBD certification in Germany.

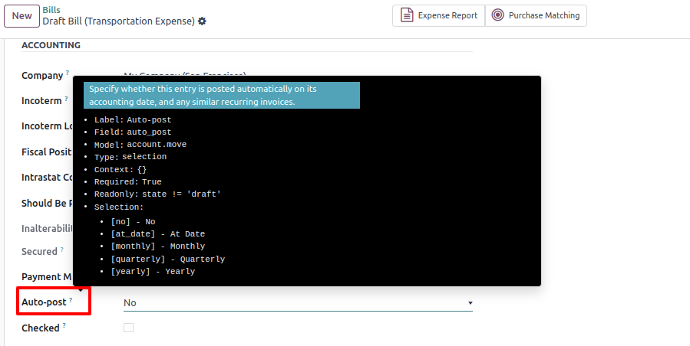

Autopost Bills

Odoo 18 enables the automatic posting of bills from chosen vendors.

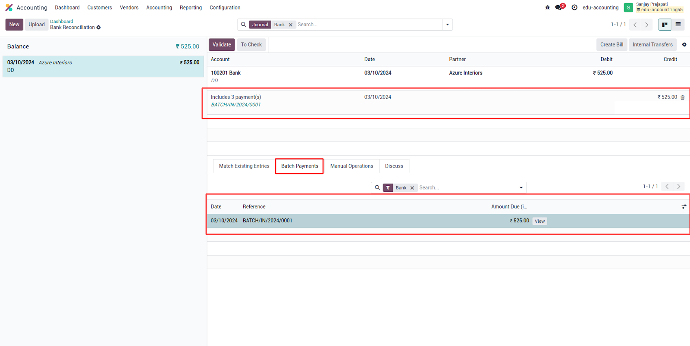

Bank reconciliation: simplified batch payment matching and statement form view

In Odoo 18, batch payments are displayed as a single folded line in the Bank Reconciliation widget, streamlining the matching process. You can access the statement form view from the Kanban view, which features a chatter for easy navigation to related transactions.

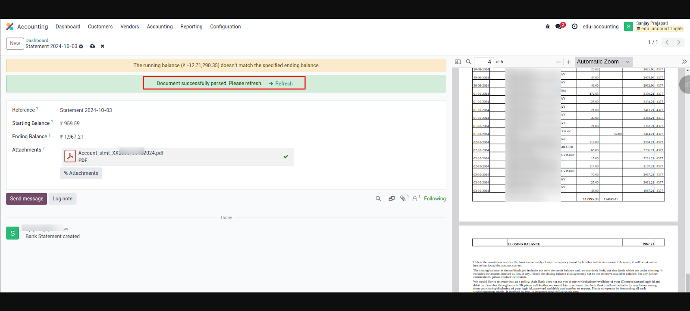

Bank statement: Import and OCR

Odoo 18 now allows bank statements to be imported even when transactions are not sorted by date. Upload PDFs or image files of bank statements to have the OCR extract the transactions automatically.

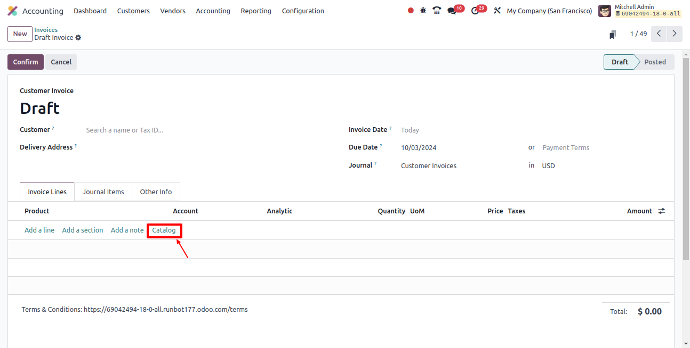

Catalog view in Invoicing

The catalog view is now available on customer invoices and vendor bills with odoo 18 accounting.

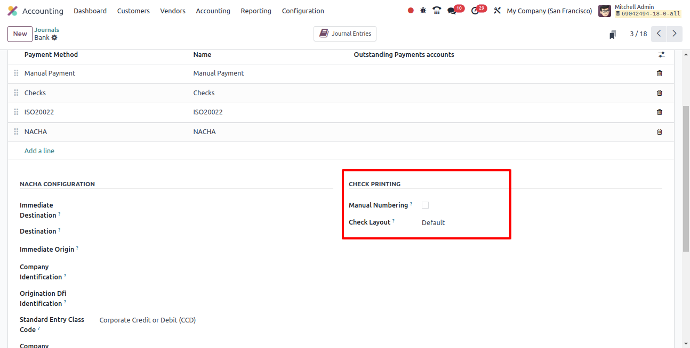

Check printing layout

Now users can select check/cheque layouts in odoo 18 under the bank journal settings.

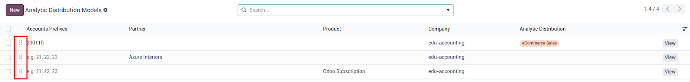

Combine analytic distribution models

Sequences are now available on analytic distribution models, allowing distribution according to multiple models provided that they are distributed on different plans.

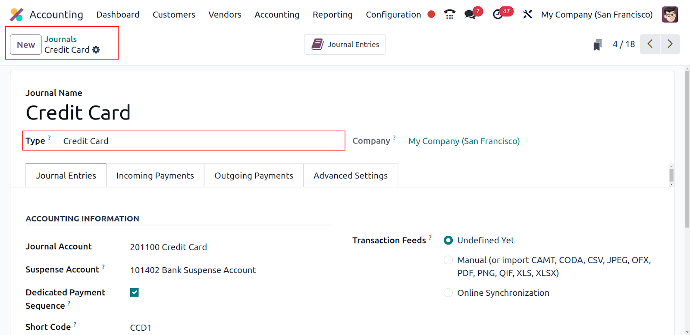

Credit card journal

In Odoo 18 accounting journal, a new credit card journal type has been introduced to facilitate the registration of credit card payments, upload statements, and manage reconciliation more efficiently.

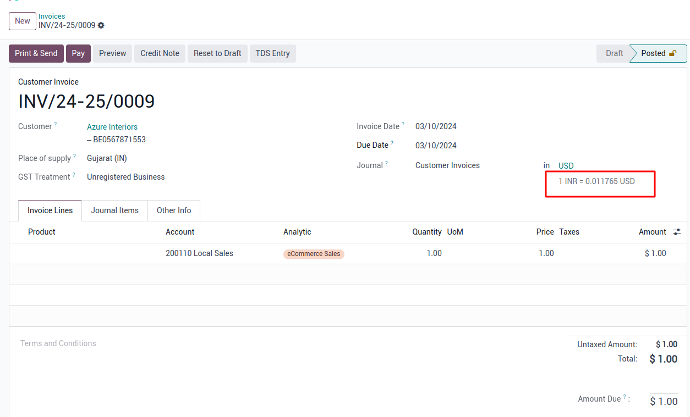

Currency exchange rate

In Odoo 18, the exchange rate is recorded on invoices and is displayed for easy reference

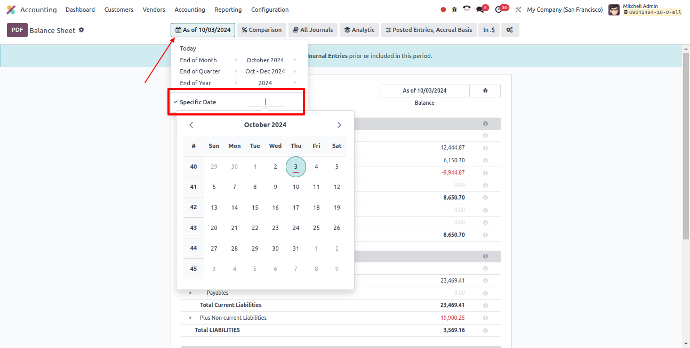

Date Selector

In Odoo 18 Accounting, the new date selector on reports allows users to effortlessly switch between different periods, enhancing navigation and making it easier to analyze financial data.

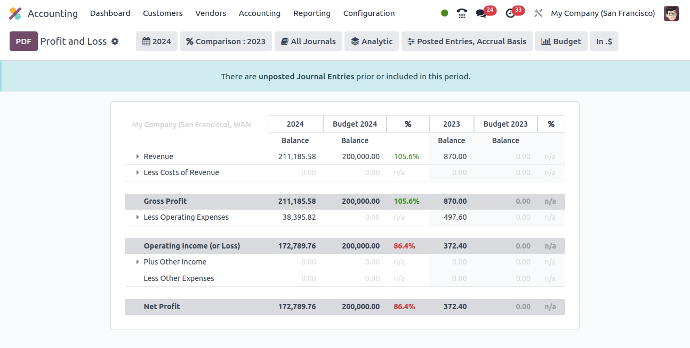

Financial budgets

In Odoo 18 Accounting, generate a Profit and Loss report that displays and compares actual financial figures with financial budgets, distinct from analytic budgets.

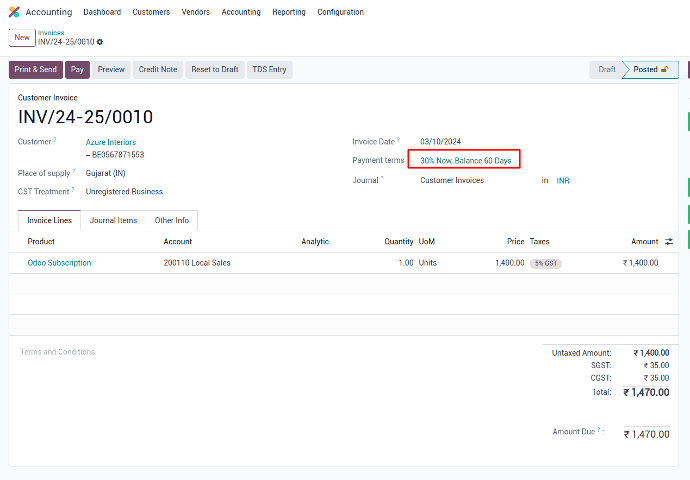

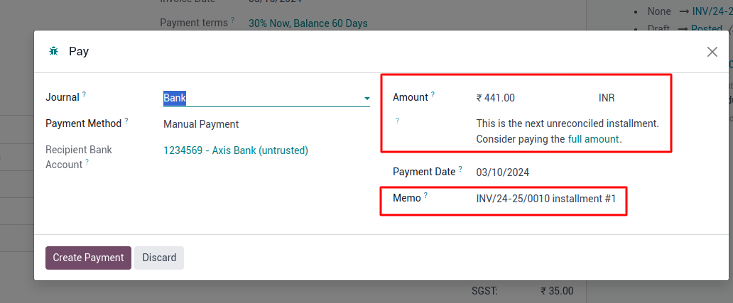

Installment payments

With odoo 18 Invoicing, registering a payment from the invoice form view considers installment amounts defined on the payment terms. The customer portal displays what has already been paid.

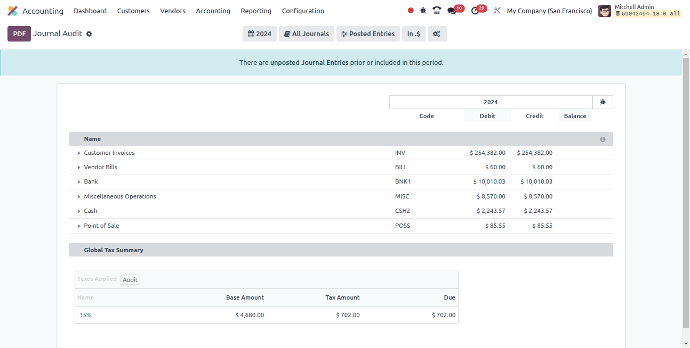

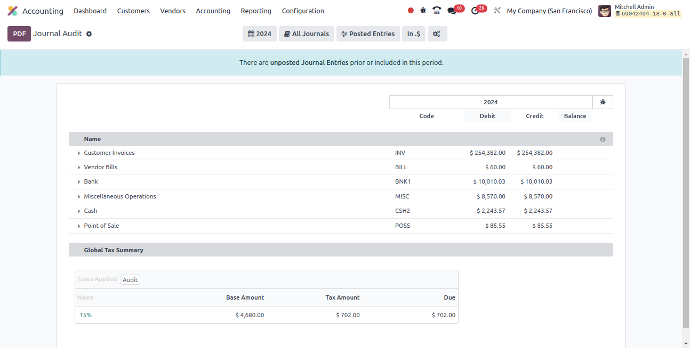

Journal report

In Odoo 18 Accounting, the user interface of the Journal Report has been streamlined to prioritize performance over displaying detailed transactions. However, detailed transactions can still be exported if needed.

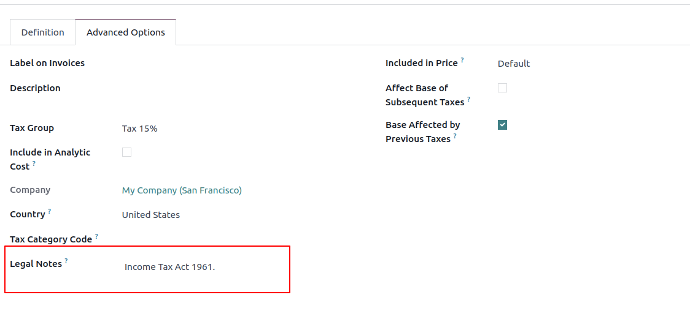

Legal notes on taxes

Odoo 18 introduces legal notes functionality that helps to add specific legal notes that can be added to taxes to be shown on documents when the tax is used. This enables covering more granular business cases than legal notes based on fiscal positions.

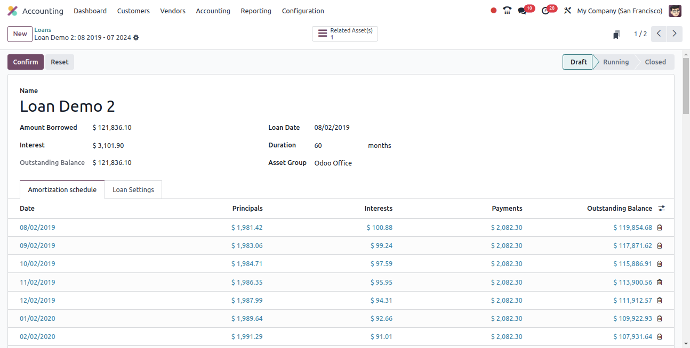

Loan Management

Manage acquired loans with automated adjustments based on your defined or imported amortization schedule.

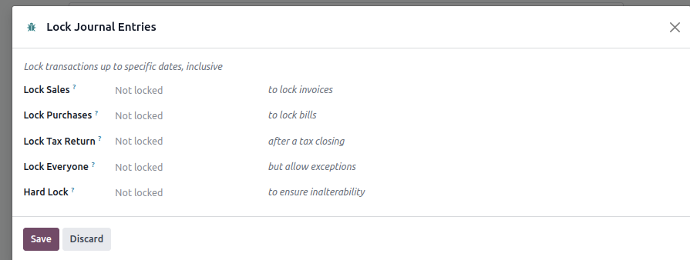

Lock dates wizard

Allow locking by journal type; add a hard lock date and exceptions management mechanism.

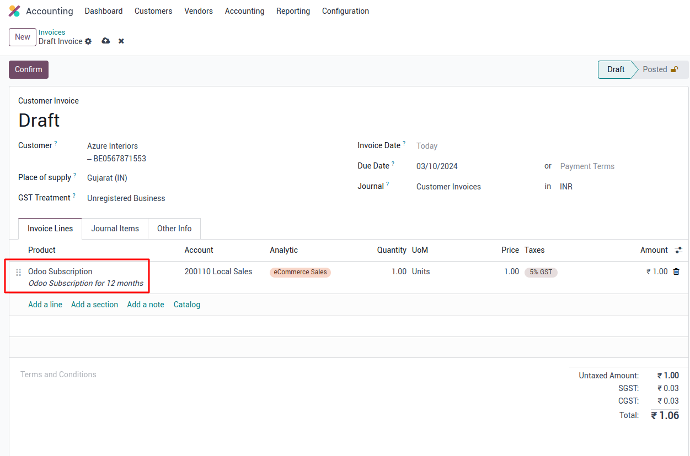

New product widget

Products and descriptions are now combined in a single column in the invoice line edition.

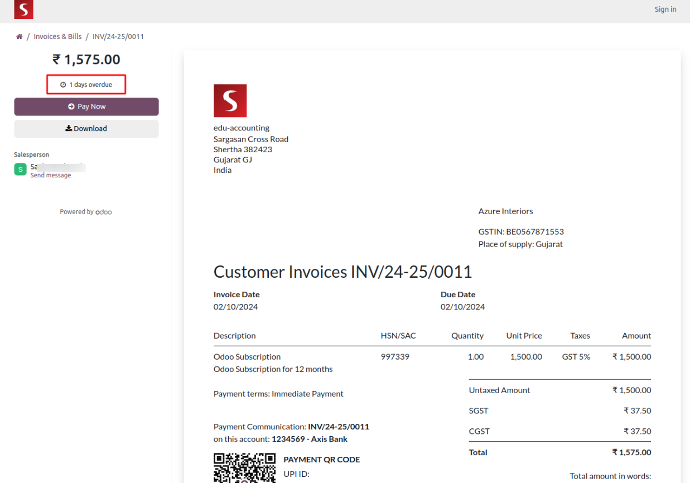

Overdue invoices and online payments

Customers are shown overdue amounts on their portal. Smart links are provided both on the portal and in follow-up reports to proceed with quick online payment of overdue amounts.

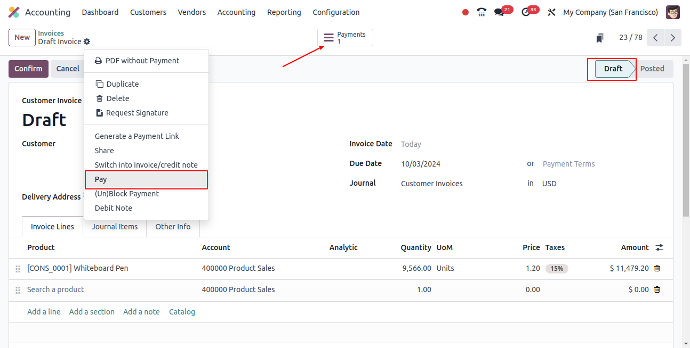

Register payment on draft invoices

It is now possible to register payments on draft invoices and bills via the action menu.

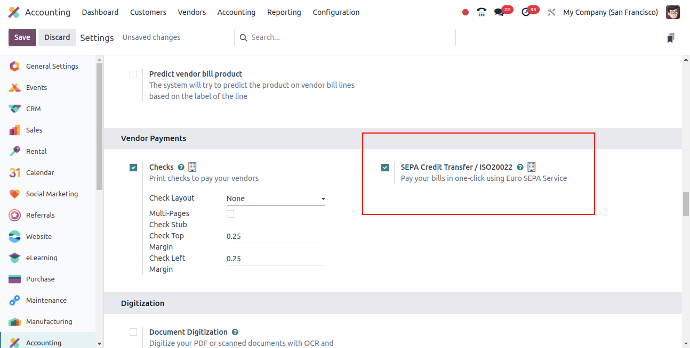

SEPA ISO 20022

With Odoo 18 the SEPA module has been refactored to clearly distinguish between the ISO20022 and SEPA payment methods.

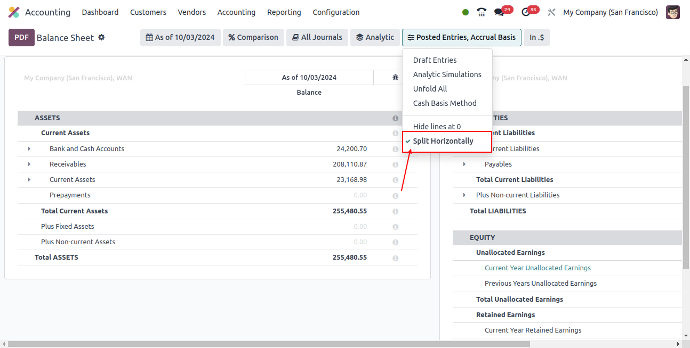

Split the balance sheet horizontally

With odoo 18 accounting Balance sheet reports can now be presented in two halves next to each other to satisfy various regional display preferences.

Other odoo 18 Accounting Features

Invoice Analysis report

In Odoo 18 Accounting, the Invoice Analysis report provides margin and a basic inventory valuation metric based on customer invoices and vendor bills, without the need for the Inventory app.

Charge bearer

Specify the charge bearer when generating batch payments for ISO20022 payment files.

Journal email alias

If an email that contains no usable file is received on an email address set as a journal alias, an automatic response is sent to the sender informing them that no document was received.

UBL invoice import

When importing a UBL (XML) invoice, Odoo 18 accounting will populate the bank account found in the XML on the partner if possible.

Updating imported invoice lines

Add information (e.g., products and tax analytics) to invoice lines imported via electronic invoicing or OCR without impacting the imported information and amounts.

Warning for potential duplicate invoices

A warning is displayed when editing a customer invoice if it is a suspected duplicate of another one by comparing the customer, the date of the invoice, and its amount.

Bills payment wizard: QR codes

The vendor bills payment wizard integrates QR codes for outgoing payments.

Shared accounts between companies

The same account can now belong to multiple companies, and accounts from different companies can be merged.

Sales taxes price included/excluded

All standard sales taxes now follow a new company setting defining them as price-included or price-excluded, making on-boarding and database setup easier. Individual taxes can be forced as being price-included or price-excluded when needed, overriding the default company setting.

Import matching numbers

In Odoo 18, you can now include a matching_number in your CSV import of lines. This feature ensures that Odoo will wait for all related account moves to be posted before attempting to recreate the reconciliation. If the reconciliation process fails, the imported reconciliation will be discarded, helping to maintain accurate financial records.

Duplicate bill detection

Odoo 18 accounting has now Improved Vendor Bill duplicate detection. Potential duplicates (using Bill references) both in draft and posted entries are looked for in the database before creating the new move. Smart links are available to directly navigate to the potential duplicate(s).

Partner payment method

Specify preferred payment methods per partner (incoming and outgoing). You can then filter and group invoices per payment method to create payments in mass more easily. When a payment for a specific partner is created, that partner's preferred payment method will be selected by default.

Payment terms

Odoo 18 added a new payment term date calculation type: "Days end of the month on the".

Payments without accounting entries

In odoo 18, payments do not create an accounting move unless an outstanding account is set on the linked payment method.

PO/Bill matching

Advanced PO matching: A new screen is available to manually match open purchase order lines and vendor bill lines together. You can also create completely new purchase orders directly from vendor bill lines and add lines as down payments on existing purchase orders.

Preferred invoicing method

Define a preferred invoice-sending method and e-invoice format for contacts to simplify the batch-sending process. Customers can then manage their preferences from the portal.

Reconciliation models: generate invoice/bill

Odoo 18 introduces new reconciliation model types to create a customer invoice or vendor bill directly from a bank transaction.

Reconciliation wizard

The amount is editable when reconciling a single journal item through the reconciliation wizard, allowing for partial write-offs.

SEPA Direct Debit (SDD)

The SEPA Direct Debit (SDD) flow and UX have been improved. Mandates can be sent through a Send & Print action. The pre-notification period is chosen on the mandate and determines when the mandatory notification will be sent to a debtor before a collection.

Conclusion

Odoo 18’s Accounting module is the core solution, seamlessly integrating with other functionalities to automate financial processes, enhance accuracy, and support data-driven decision-making.

As an official Odoo partner, SerpentCS delivers comprehensive Odoo ERP development services tailored to diverse business requirements. We have successfully implemented numerous ERP projects for startups and small-to-medium enterprises globally. For more details, contact us at contact@serpentcs.com.